Self-driving cars are occupying a lot of headline space in the news today. To some degree, there are already cars with certain driverless features on-the-road today. This includes cars with features like autonomous braking, self-parking, adaptive cruise control, etc.

These features aid drivers who are often distracted by mobile phones, children, and countless other things to drive more safely. However, the day of the completely autonomous or driverless car is swiftly approaching and that could present a conundrum of sorts for your auto insurance when accidents occur.

Many people applaud autonomous vehicles as a pathway to providing greater independence for seniors and even for those who have disabilities. However, the heavy reliance on these cars for technology and interacting with existing technology, added to the innate ability drivers have to act outside of the realm of rationality presents real problems for programming the AI of these cars and keeping them safe from hackers and those who would use them to do harm.

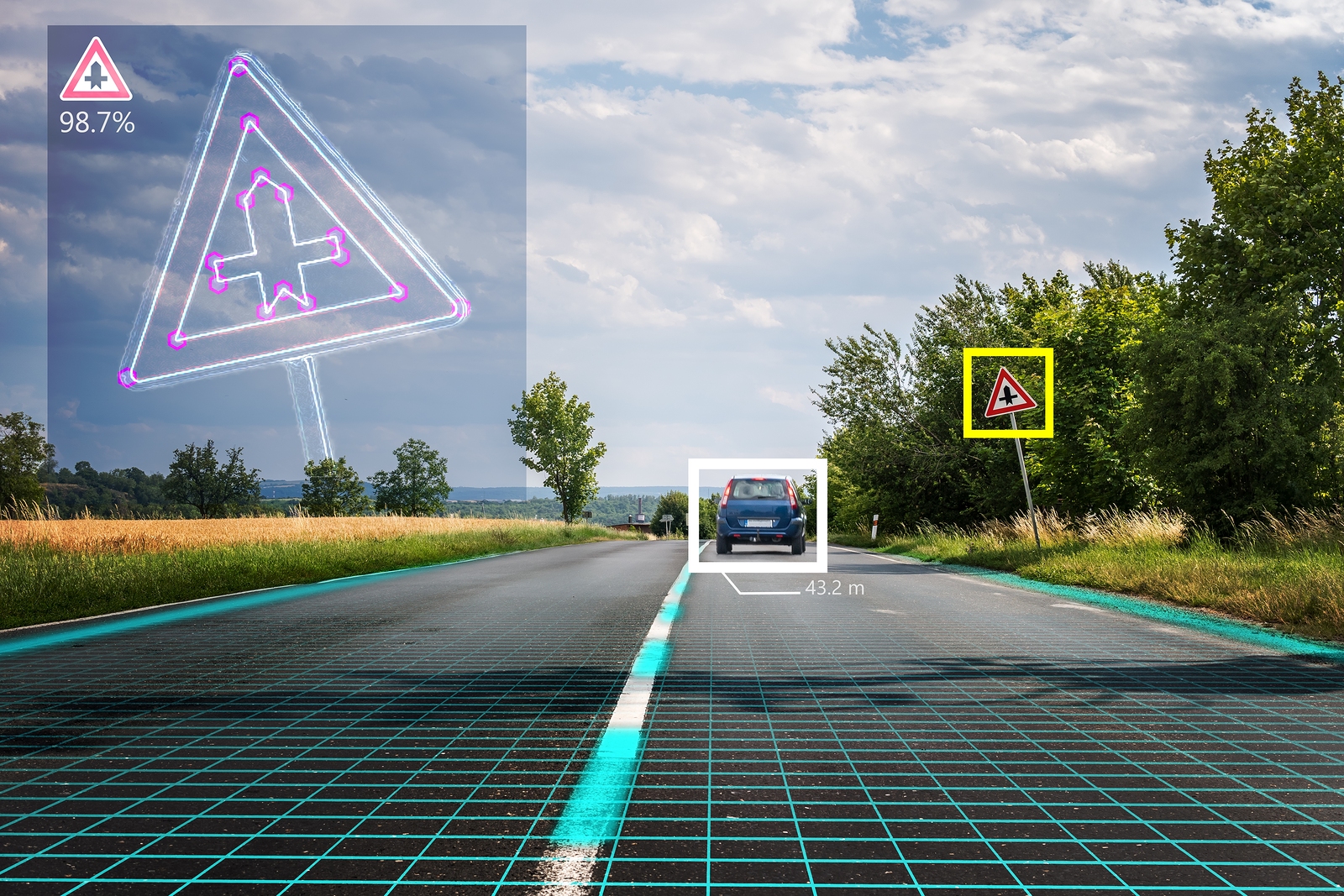

The Hill reports that the current belief is that driverless cars will prevent up to 90 percent of all traffic related deaths. However, in July of 2016 the first fatality related from a driverless vehicle occurred in Florida when the sensors on the vehicles failed to “see” a turning semi-truck against a bright sky. With so few driverless vehicles currently on the road, we can expect to see more accidents like this in the future.

The question for insurance companies on these occasions is “who is at fault?” With many insurance claims determined according to “fault” who would the “at fault” person be when no one is driving the car? The larger the accident, the greater the risks could be and who is ultimately responsible when these accidents occur? At the moment, there isn’t legislation in place, nor is there precedence for cases such as this.

What does all this mean for the insurance industry as a whole? For the most part, it means they are playing a waiting game, but will be required to hurry up and get in the game once things start moving. For the moment, there are very few driverless cars on the road. As those numbers increase, so will accidents involving them and legislation addressing responsibility.

Some predict that driverless cars will eliminate the need for auto insurance altogether. That likely is not the case as there are always things that can go wrong from human error, poor programming, hacking, and more. Until these things are eliminated auto insurance will be necessary – no matter who is (or isn’t) in the driver’s seat.