What are the Best Ways to Save on Homeowners Insurance?

Your homeowners insurance rate can vary by hundreds of dollars, according to the Insurance Information Institute (I.I.I.), and this depends on which insurance company you get your policy from. Many homeowners stop at a security system, smoke detectors and discounts for ways to save money on their policy. However, there are other ways that can shave more money off your rates. Here are some of the best ways to save on your homeowner’s insurance.

Tips to Reduce and Compare Landlord Insurance Quotes

Getting landlord insurance quotes can be a huge hassle, but no one wants to pay more for insurance than necessary when renting homes out to tenants. That means you need to get a few quotes from different insurance companies so that you can compare policies and find the best rates to meet your needs.

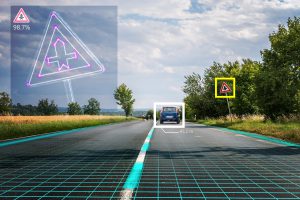

What You Need to Know about Driverless Cars and Insurance

Self-driving cars are occupying a lot of headline space in the news today. To some degree, there are already cars with certain driverless features on-the-road today. This includes cars with features like autonomous braking, self-parking, adaptive cruise control, etc.

How Much Insurance Do I Need for My Car?

Although there’s no set amount of auto insurance that’s perfect for all drivers, it all comes down to the type of car you own and the coverages you’re looking to get. Below are some of the most common types of coverages you should add to your policy. Also, you can add on other “optional” coverages as you see fit.

What are Your Rights as an Apartment Renter?

Renting an apartment can be exciting for some and ho-hum for others. However, if you don’t take the time to learn what your rights as an apartment renter are, your new crib may quickly feel like an albatross, rather than a source of liberty and freedom for you. These are a few rights you need to know about as a renter.

Modern Trends in Lawn Cutting: Smart Mowers

The average person in the U.S. spends around 70 hours annually on their lawn. Spend this time better. Thankfully, we now are seeing a rise in robotic smart mowers.

How to Choose Home Insurance: Step By Step

You’ve just bought your new home. Now it’s time to insure it. Don’t worry; obtaining homeowners insurance isn’t as intimidating or difficult as your family and friends likely make it sound. However, if you’re trying to figure out how to choose home insurance without having to pay a huge monthly rate or jump through hoops, you’ll need a little knowledge under your belt. Below are simple steps to land you an affordable and comprehensive home insurance policy.

Renting vs. Buying Pros and Cons | bolt Insurance

If you are thinking of getting a house, there is one big question that every potential homeowner needs to decide: Rent or buy. You may not know all the renting vs. buying pros and cons, so take all of the following aspects into consideration. Everyone’s situation is different, so it is important that you make the decision that is right for you and not anyone else. Of course, regardless of what you choose, bolt insurance Agency can offer either renters insurance or homeowners insurance. Being insured is vital no matter which side you come down on.

How to Shop for Homeowners Insurance

When first buying a home, you’re probably asking yourself how you go about shopping for homeowner’s insurance. You’re not sure where to get it, how much to get or even when you should get it. Buying a home is a huge investment — and you’ll want to ensure you’re properly protect it. It’s not that difficult to get homeowner’s insurance, but this guide will help you during the process of obtaining your policy.

New Rearview Mirror Makes Passengers Invisible

This fall the dealerships will be hit with the 2018 Nissan Armada and their electronically-aided mirrors. These intelligent rearview mirrors will be equipped with LCD screens connected to a camera. The goal is to enhance the driver’s field of view making it a safety feature that can help drivers avoid car accidents.